NIBL Samriddhi Fund – II

Build Wealth with NIBL Samruddhi Fund-2 Schemes in Nepal

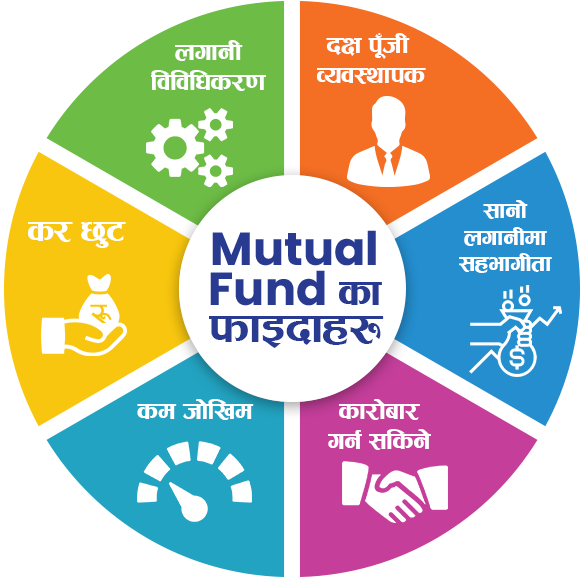

At NIMB Ace Capital we intend to follow a disciplined and process oriented investment approach for mutual fund to help investors achieve their financial goals. Choose from equity, debt, and balanced funds designed to maximize returns. Get the best benefits of investing in mutual fund schemes. Start your smart mutual fund investment journey today.

Features

| Nature of the Scheme | Closed End Fund |

| Fund Name | NIBL Mutual Fund |

| Scheme Name | NIBL Samriddhi Fund – II |

| Investment Objective | To generate returns by investing in a mix of securities comprising of equity, equity related instruments & fixed income instruments as allowed by prevailing rules/regulations on mutual fund. |

| Corpus | NPR 1.2 Billion Corpus amount may reach a maximum up to NPR 1.5 Billion (25% more) if oversubscribed as allowed by prevailing regulation on mutual fund. |

| New Fund Offer (NFO) Par Value | NPR 10.00 |

| NFO Unit | 120,000,000 Units |

| Minimum Unit to apply | 100 Units |

| Maximum Unit to apply | 10% of Issue Size |

| Issue Open Date | As per prospectus |

| Approval Date | 03/01/2078 BS (16/04/2021 AD) |

| Allotment Date | 24/01/2078 BS (07/05/2021 AD) |

| Maturity | 10 Years from the date of allotment of units |

| Maturity Date | 23/01/2088 BS (07/05/2031 AD) |

| Allotment of Units | The Units will be allotted as per Securities Issues and Allotment Directive 2074 |

| Dividend Payout Strategy | The cash dividend will be pay out from the realized profits in proportion to investments made, retained earnings. |

| Listing | The Units will be listed in Nepal Stock Exchange Ltd. (NEPSE) for trading until the maturity of the scheme. |

| Fund Supervisors Fees | 0.12% of Net Asset Value (NAV) |

| Fund Management Fees | 1.5% of Net Asset Value (NAV) |

| Depository Fees | 0.2% of Net Asset Value (NAV) |

| Withholder PAN NO | 201387492 |

- Securities registered with SEBON

- Securities called for public offering

- Securities listed in the Nepalese Stock Exchange

- Debentures, Treasury Bills and other instruments of money market issued by Government of Nepal or Government Agencies receiving full guarantee or protection of Government of Nepal or NRB

- Bank Deposits

- Money Market instruments

- Other areas prescribed by SEBON

Sponsor

Nepal Investment Mega Bank Limited

Corporate Office: Durbar Marg, Kathmandu, Nepal

Fund Manager and Depository

NIMB Ace Capital Limited

(Wholly owned subsidiary of Nepal Investment Mega Bank Ltd.)

Head Office: Uttar Dhoka, Lazimpat, Kathmandu, Nepal

Fund Supervisors

The Fund Sponsor has appointed the following prominent professionals as the Fund Supervisors of NIBL Mutual Fund.

- 1.Dr. Bimal Prasad Koirala

- 2.Dr. Shambhu Ram Simkhada

- 3.Dr. Durgesh Man Singh

- 4. CA. Jitendra Bahadur Rajbhandary

- 5. Mr. Raju Nepal

For more information

To know more about the NIBL Samriddhi Fund – II, please fill in this form or call us at following numbers

Ext no.: 432 & 411